It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. The double-entry system of bookkeeping is common in accounting software programs like QuickBooks. With this method, bookkeepers record transactions under expense or income. Then they create a second entry to classify the transaction on the appropriate account. Bookkeeping is the ongoing recording and organization of the daily financial transactions of a business and is part of a business’s overall accounting processes.

Is it worth paying a bookkeeper?

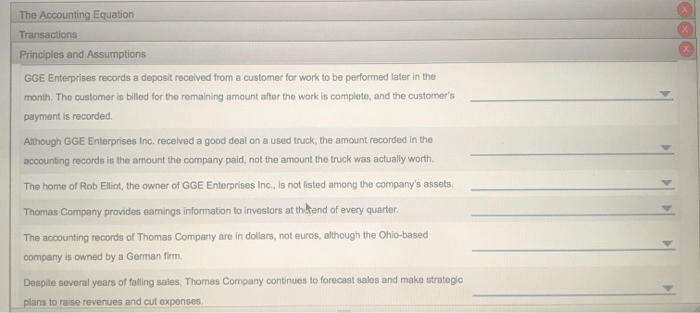

Many bookkeeping software options automate the tracking process to eliminate errors. Most accounting software offers a range of features that are suited for almost any type of small business. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business. On the other hand, accountants are generally equipped with an accounting degree and may even be state-certified CPAs. You can expect most bookkeepers to maintain the general ledger and accounts while the accountant is there to create and interpret more complex financial statements.

Get a customized bookkeeping software recommendation

Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. Here’s an example of how you’d enter a transaction in the Intuit software. Certifications aren’t necessary to become a bookkeeper but can signal to employers that you have the training and knowledge to meet industry standards.

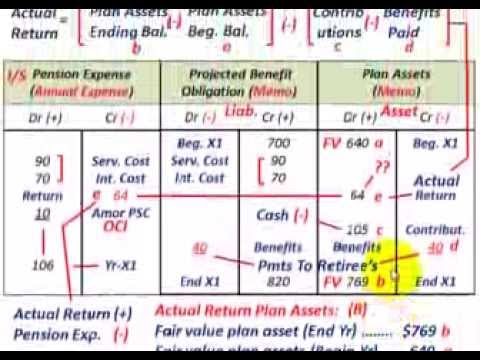

Perform Journal Entries to Debit and Credit Accounts

Using the data you gain from keeping a ledger, your next step will be to generate and prepare financial reports for analysis. The major reports to include are the profit and loss, the balance sheet, and a cash flow analysis. Additionally, the aged accounts receivables and aged accounts payables reports are helpful in knowing which customers have not paid and which vendors are yet to be paid. These reports will help you gain greater insights into the financial health of your small business. Fortunately, small business owners don’t need to be experts in mathematics to find success when doing their own bookkeeping. There are many ways to divide bookkeeping responsibilities and leverage powerful technology and small business accounting software for more accurate expense tracking.

Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York. You’ll want to create a contract that outlines details, such as https://www.personal-accounting.org/ deadlines, rates and expectations so that everyone is on the same page. QuickBooks Online has some of the best reporting and bookkeeping features money can buy. Xero, Sage Business Accounting, and Zoho Books have stellar reports at a lower starting price than QuickBooks.

If you find that you have a talent for and enjoy the process, you may consider starting your own bookkeeping business providing this service to others. There’s always a demand for experienced, efficient bookkeepers in nearly every industry. Companies often outsource the organization of their finances to independent professionals, then hire accountants for more complex issues and tax filing.

- The first step you’ll need is a business bank account, which allows you to keep your personal and business expenses separate.

- They are vital to managing a business’s finances by documenting transactions, generating reports, and assisting with accounting efforts.

- For instance, the job outlook for accountants and auditors has a 6 percent growth rate from 2021 to 2031.

- Another type of accounting method is the accrual-based accounting method.

- The single-entry method will suit small private companies and sole proprietorships that do not buy or sell on credit, own little to no physical assets, and hold small amounts of inventory.

- Tracking your AR, usually with an aging report, can help you avoid issues with collecting payments.

Tracking your expenses is an essential part of managing your finances. By keeping track of every dollar you spend, you can gain insight into where your money is going and make informed decisions about allocating your resources. https://www.accountingcoaching.online/tokyo-olympic-games-get-official-2021-dates/ Accounts receivable (AR) is the money your customers owe you for products or services they bought but have not yet paid for. It’s important to track your AR to ensure you receive payment from your customers on time.

As a bookkeeper, you will verify and balance receipts, keep track of cash drawers, and check sales records. Bookkeepers also deposit money, cash checks, and ensure correct credit card transactions. You depreciation tax shield also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping. You record transactions as you pay bills and make deposits into your company account.

Financial transactions are business activities that involve money, such as sales, expenses, and payments. Recording and organizing these transactions in a timely manner is essential for effective bookkeeping. Generally, if your assets are greater than your liabilities, your business is financially stable. Note that certain companies, such as those in service-based industries, may not have a lot of equity or may have negative equity. At tax time, the burden is on you to show the validity of all of your expenses, so keeping supporting documents for your financial data like receipts and records is crucial.

Finally, if you want someone else to do your bookkeeping for you, you could sign up for a cloud-based bookkeeping service like Bench. We’ll do your bookkeeping for you, prepare monthly financial statements, give you expense reports with actionable financial insights, and we’ll even file your taxes for you when the time comes. Using the accrual accounting method, you record income when you bill your customers, in the form of accounts receivable (even if they don’t pay you for a few months). Same goes for expenses, which you record when you’re billed in the form of accounts payable. Lenders and investors want a clear idea of your business’ financial state before giving you money.